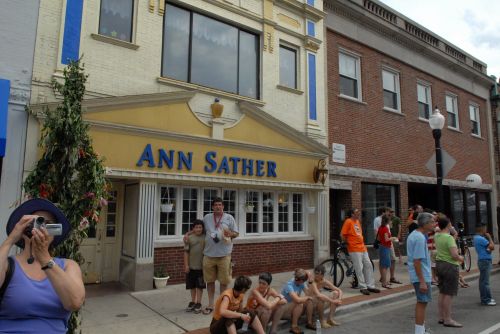

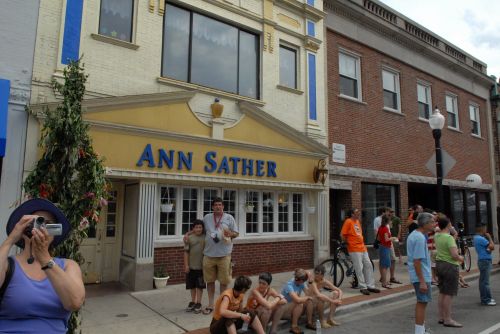

Ann Sather's is an excellent restaurant. I enjoy the eggs Benedict best. Do you know the Chicago Alderman that owns this eatery? Do you know the Alderman that he replaced? Clout is a funny thing in Chicago, just try and keep it if you can! Photo of Patrick and David McDonough. I would say the 2008 "Midsommarfest" was fun and I had a good time. Andersonville is a great town in and of itself. It was a great way to spend my Father's Day. I hope you spent yours with your family and not gambling at the boat! Patrick McDonough.

Ann Sather's is an excellent restaurant. I enjoy the eggs Benedict best. Do you know the Chicago Alderman that owns this eatery? Do you know the Alderman that he replaced? Clout is a funny thing in Chicago, just try and keep it if you can! Photo of Patrick and David McDonough. I would say the 2008 "Midsommarfest" was fun and I had a good time. Andersonville is a great town in and of itself. It was a great way to spend my Father's Day. I hope you spent yours with your family and not gambling at the boat! Patrick McDonough.

Ann Sather's is an excellent restaurant. I enjoy the eggs Benedict best. Do you know the Chicago Alderman that owns this eatery? Do you know the Alderman that he replaced? Clout is a funny thing in Chicago, just try and keep it if you can! Photo of Patrick and David McDonough. I would say the 2008 "Midsommarfest" was fun and I had a good time. Andersonville is a great town in and of itself. It was a great way to spend my Father's Day. I hope you spent yours with your family and not gambling at the boat! Patrick McDonough.

Comments

Alderman Thomas Tunney

(D-44th), the City of Chicago's first openly gay alderman, succeeded Alderman Bernard Hansen who retired for health reasons in 2003.

Alderman Tunney is owner of Ann Sather's restaurants. Great food and friendly staff!

Posted by: scrootined | June 16, 2008 6:59 PM

U.S. government struggles to contain economic depression

The U>S> government is making every move possibble to control and manage the depression we are now in. Banks were ordered by the feds to report if and when there will be a run on them to where depositors cannot be paid withdrawls(think of the federal bailout of Bear Stearns). Property values are declining at levels only seen in the last depression of the 1930's. This depression is worse in that we have inflation along with a depressed economy. The depression of the 1930's was a deflationary depression.This was caused by the government lying about economic figures in order to not alarm the public. Property values will not recover for at least 5-8 years. This market should have corrected after the 1999-2000 market crash where the stock market went down 50%. The government at that time began lying about economic figures big time in order to contain the market correction. So combined with lying about figures and dropping the interest rates to rock bottom levels, the feds were able to fuel an artificial balloon boom in realestate and the whole economy. Inflation figures do not factor in fuel or food costs! Hello! Reguardless of the shape of the economy the feds will keep supplying phony data and tell us everything is ok. Property values are declining by 20 - 40% and the feds continue their charade of telling us everything is fine. Stay tuned on this one cause the worst is yet to come. (Tom Ryan)

Single-family home prices dropped 7.7% in the first quarter in the largest year-over-year decline since the National Association of Realtors began reporting prices in 1982.

The median sales price fell to $196,300, down 4.8% compared with the last three months of 2007.

Lawrence Yun, the chief economist of NAR, attributed much of the record decline to liquidity problems dragging down high-priced markets.

Slideshow: 6 real estate bargains

"These are highly unusual results because there were very few jumbo loan originations in the latest quarter," he said. "So sales are much slower in high-cost areas."

Jumbo mortgages skew results

That sales slowdown changed the mix of houses sold.

In California, according to Yun, homes bought with jumbo mortgages - more than $417,000 - accounted for 40% of all sales before liquidity for these loans dried up during the summer of 2007. Since then only 10% of sales in California involved jumbo loans.

In February, Freddie Mac and Fannie Mae, the government sponsored enterprises that guarantee a market for conforming loans, have raised the $417,000 cap to include mortgages of up to $729,750, but lenders were still charging much higher rates for these "conforming jumbos," between 1% and 1.5% more than ordinary conforming loans. The higher rates are discouraging sales in higher price ranges and so skewed NAR's median price results.

Many of these same markets were also among the hardest hit by the subprime implosion, which forced many lower priced homes back on the markets, again dragging down NAR's results.

That helped put many California and other Sun Belt cities, with their toxic combinations of both high prices and heavy proportions of subprime mortgages, among the biggest losers.

In California, Sacramento prices plummeted 29.2% to $258,500 compared with last year and Riverside prices fell 27.7% to $287,100. Prices in Las Vegas fell 20.2% to $247,600 and those in Phoenix dropped 15.4% to $222,200.

Some Midwestern cities, hard hit by factory closings, also suffered huge losses with Lansing, Mich., prices falling 26.9%. Saginaw, Mich., had the lowest median prices of any of the 150 markets studied; a median house in Saginaw sold for just $65,400.

"You have two themes: the weak industrial economies under increasing pressure by struggles of the Big Three automakers and the deflating of what were once the most prominent bubble markets," said Michael Youngblood, an analyst with FBR Investment Management.

About of a third of the markets did show gains. The best performer in the nation was Binghamton, N.Y., where prices rose 11.8% to $109,700. Then came Peoria, Ill., up 10.4% to $119,000 and Spartanburg, S.C., where prices rose 10.2% to $130,300.

Regionally, in the Northeast, single-family home prices rose slightly, 3.2% to $280,000. But prices in the South dropped 7.5% to $164,200, in the Midwest they fell 7.9% to $142,700 and in the West they plunged 12.3% to $296,300.

Foreclosures put more homes in play

Hurting home prices were big rises in foreclosure rates over the past 12 months, which threaten to get even worse. Delinquencies more than doubled over that time and more than 155,000 lost their homes in bank repossessions during the first three months of the year. With many adjustable rate mortgages (ARMs) poised to reset this year to higher interest rates, defaults could go even higher.

"Yes, but I hasten to say it's not merely the ARMs," said Youngblood. "Fixed rate loans are performing poorly as well."

All that foreclosure activity added to the glut of homes on the market. The total inventory has risen to an average of 10 months worth of unsold homes. In addition, a record number - 2.9 million - of vacant homes are up for sale, according to the Census Bureau.

The big inventory has led to aggressive price slashing and increased incentives by builders looking to sell homes. They've also cut way back on housing starts, which are at a 17-year low.

The pace of existing home sales, at about 492,000 a month, is about a third less than its peak during the summer of 2005.

Condo prices fared a bit better than single-family homes. The median price fell just 3% since early 2007. The worst hit market was the Sarasota area, where condos dropped 35% over the past 12 months to $268,500. Sacramento condo price cratered 33.4% to $147,200. In Miami, prices fell 26.4% to $176,100.

The best performing condo market was about as far from the madding crowds of South Beach as one can get: Bismarck, N.D., condo prices soared 36.4% compared with 12 months ago, to $124,900.

The price declines in falling markets may not have run their course. Some analysts point to low home prices in many Midwestern cities and assert there's not much room for prices to fall but Youngblood disagrees.

"If we'd had this discussion a year ago, we would have said the same thing - how much further can they fall?" he said. "But jobs are declining and people are moving out and you're getting sharper home price declines than you ordinarily would."

Also, according to Youngblood, the sheer volume of foreclosures takes a toll. "Recent studies report that foreclosed properties sell for an average of 20% less than comparable properties that have not been foreclosed on," he said.

As for the bubble markets that have already lost 30% of their values, Youngblood thinks their declines are not over. He expects some to drop another 20% or so through February 2009.

Posted by: tom ryan | June 19, 2008 2:12 AM